《Hoarding Bitcoin》 Chapter 2: Exiting Too Early Due to a Lack of Vision

In the ten years of Bitcoin, some people have come and gone, some have left and returned, some have stayed, and some have left never to return.

The vast majority of early Bitcoin players have already exited, and many people have watched Bitcoin skyrocket without ever getting on board. This is good news for us, because if they were all on board now, would the price of the coin still be tens of thousands?

Hesitating to get on board, eager to get off, the reasons may be multifaceted, but the main one is that the vision is not big enough.

Vision determines perspective, and perspective determines action.

When Bitcoin was priced at 10 USD, they said it was too expensive.

When Bitcoin was priced at 100 USD, they said it was too expensive.

When Bitcoin was priced at 1,000 USD, they said it was too expensive.

When Bitcoin was priced at 10,000 USD, they said it was too expensive.

Bitcoin always seems too expensive, they never want to buy.

When Bitcoin was priced at 10 USD, we said it was too early.

When Bitcoin was priced at 100 USD, we said it was too early.

When Bitcoin was priced at 1,000 USD, we said it was too early.

When Bitcoin was priced at 10,000 USD, we said it was too early.

Bitcoin always seems too early, we never want to sell.

Without a vision, you might be able to survive a bear market, but you definitely can’t hold on to a bull market. You will sell as soon as it rises, don’t disbelieve, the 480,000 brother is a living example.

The most important question to understand in order to remain unmoved in both bull and bear markets is, how big is its future?

Another hundredfold increase? You’re too pessimistic, a hundredfold is too little, let me share my vision.

The core application of Bitcoin is value storage, and its future goal is to become people’s first choice for value storage.

So, what did we use to store value before Bitcoin appeared? In other words, when we make a sum of money, apart from the part left over after consumption, in what form do we preserve wealth? They are mainly gold, currency, and real estate.

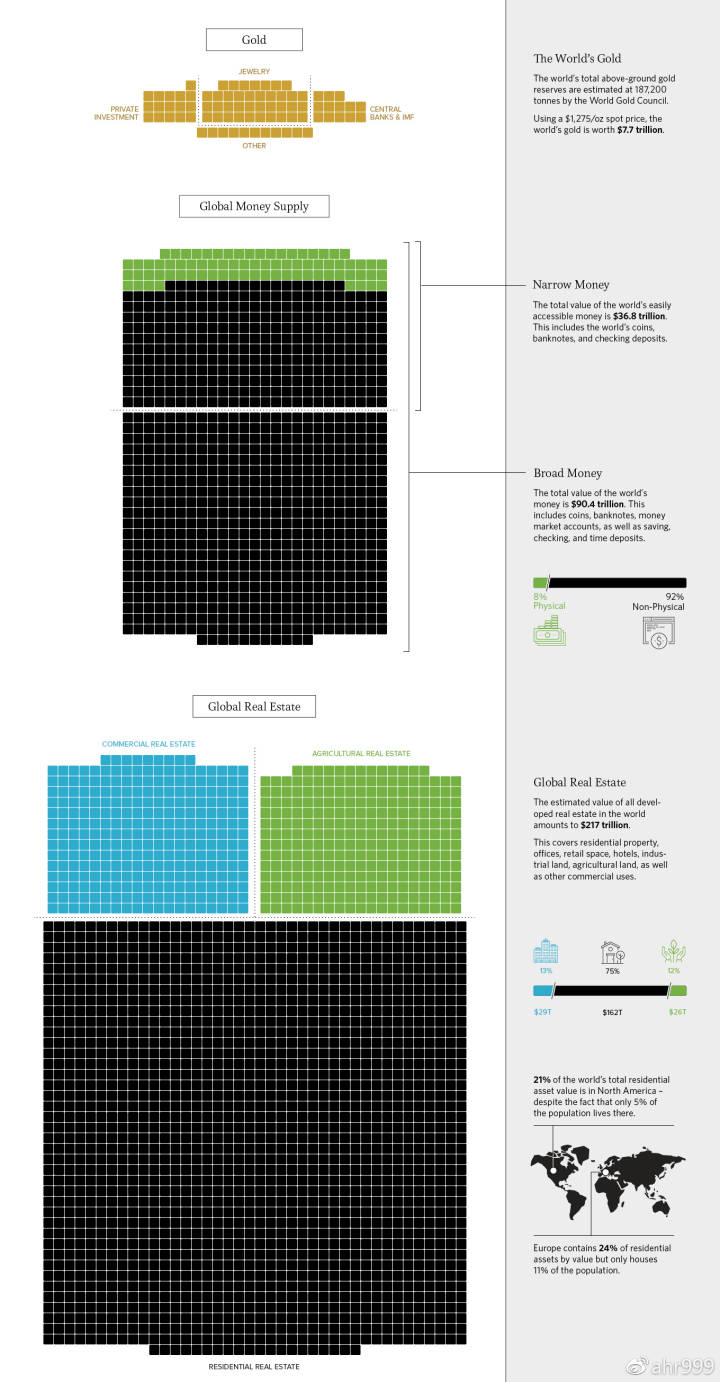

total amount of world gold、currency and real estate:

The total market value of global gold is $7.7 trillion, the total amount of broad money is $90.4 trillion, and real estate is $217 trillion.

The main use of gold now is as a store of value, and in terms of storing value, Bitcoin is superior to gold in every aspect, and it’s only a matter of time before its market value surpasses that of gold.

Broad money includes: cash, time and demand deposits, securities company client margins, etc. Apart from cash (which accounts for 8%) that is used for circulation, the rest is used for storing value.

The primary use of real estate is probably still for living and use, but a considerable proportion is definitely used for storing value. If it weren’t for Bitcoin, I would probably also use most of my funds to buy real estate. Since there is no available ratio to check, let’s temporarily assume that 20% of real estate is used for storing value (this ratio does not affect the order of magnitude of the final result).

So, how big is the global total store of value market? $7.7 trillion + $90.4 trillion × 92% + $217 trillion × 20% = $134 trillion.

The total amount of Bitcoin is only 21 million, with about 3 million permanently lost. Considering Bitcoin’s absolute advantage as a store of value relative to gold、currency and real estate, each Bitcoin will rise to $7.5 million.

Is that all? Of course not.

The total amount of world wealth is growing at a rate of 6% per year, and after 10 years, the total amount will be 1.8 times what it is now, and after 20 years, it will be 3.2 times. Therefore, assuming that Bitcoin’s store of value function is widely recognized after 20 years, its price should be $24 million.

The above calculations only consider Bitcoin’s function as a store of value. If other factors are taken into account, Bitcoin’s total market value will be even higher.

In other words, Bitcoin still has a thousandfold growth space. Every four years, when the production is halved and the supply suddenly decreases, a new round of price surges will come.

Sometimes, when I pass through the busiest parts of the city, moving among the crowds, watching people come and go, I wonder what jobs these people do? How are their families? What are they busy pursuing all day? How many of them know about Bitcoin? And how many can understand the future of Bitcoin?

Although Bitcoin has risen to a high of $60,000, it is clear that 99% of the people in the crowd still do not understand Bitcoin and still do not own it. This is certainly good news, and it also means that the upside potential for Bitcoin is still huge.

Currently, although the Bitcoin network has been running stably for more than ten years, the client has not yet been upgraded to the official v1.0 version. We are actually just a group of beta users, and the real users have not yet arrived.

If Bitcoin is compared to a child, then this child has not yet been born and is still a fetus in the womb. Although it has grown ten million times from a fertilized egg to a fetus, there is still infinite growth space from a fetus to an infant to a child to an adult.”